Market Breadth: Moving Averages

➜ Members: login to the website to view the full post: Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

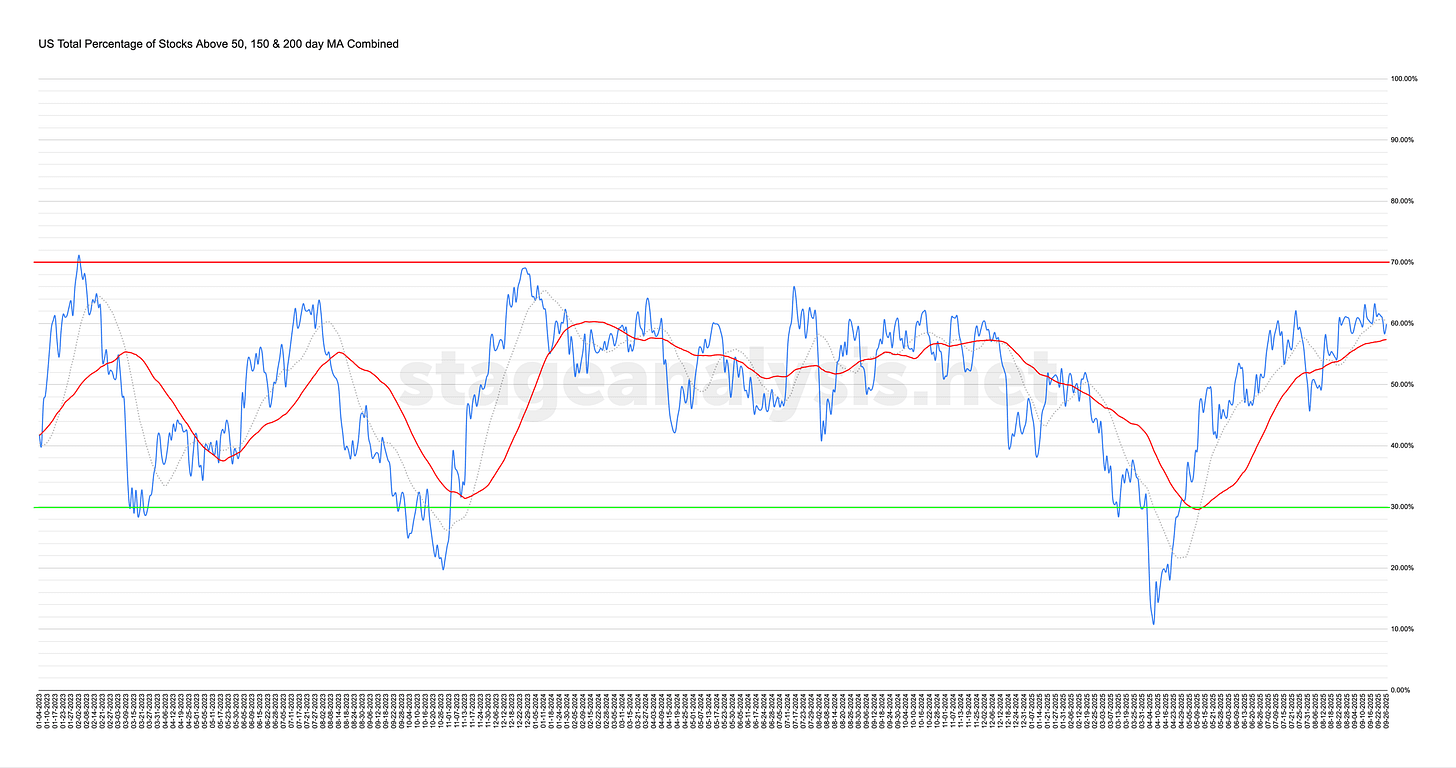

59.89% (-1.30% 1wk)

Status: Neutral Environment

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) decreased by -1.30% this week.

Therefore, the overall combined average is at 59.89% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

The combined average pulled back this week, closing below its shorter-term 20 day MA by -0.61%, but it is still above its 50 day MA (signal line) by +2.52%. Therefore, the status has changed to a Neutral Environment status to start the new week.

Stage Analysis Members - Save up to 20% with Quarterly and Annual Billing

*We are not licensed to give investment advice. All content provided in this email is for educational purposes only and should not be construed as investment advice. You should not invest in any stock based solely on the information provided. Trading stocks is highly speculative and involves a high degree of risk of loss. You could lose some or all of your money. You should conduct your own independent research and due diligence to verify any information provided.